|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Place to Refinance My House: A Beginner’s Guide to Making Smart ChoicesRefinancing your home can be a savvy financial move, but finding the best place to refinance can be overwhelming. This guide will help you navigate the options and make an informed decision. Understanding RefinancingBefore diving into where to refinance, it's important to understand what refinancing entails. Essentially, it involves replacing your existing mortgage with a new one, often with better terms. Benefits of Refinancing

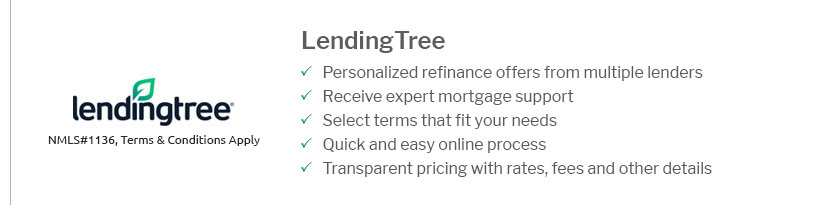

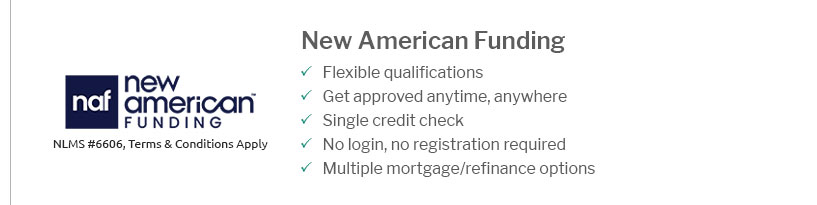

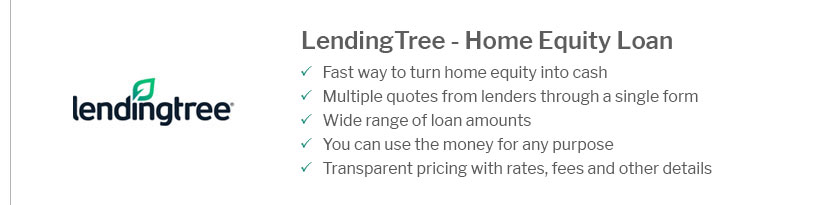

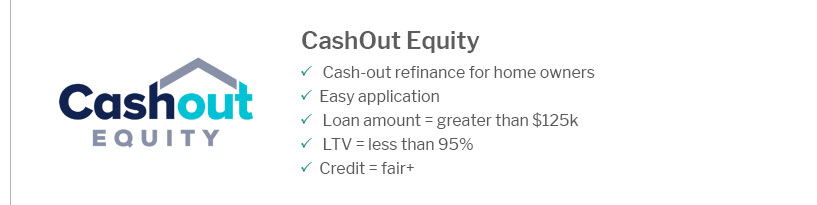

Where to Refinance Your HouseChoosing the right place to refinance involves comparing rates, terms, and the reputation of lenders. Consider banks, credit unions, and online lenders. Traditional BanksBanks offer familiarity and trust, often providing competitive rates for existing customers. Visiting your bank can be a good first step. Credit UnionsThese member-owned institutions may offer lower rates and fees compared to traditional banks, making them a worthwhile option. Online LendersOnline lenders can offer convenience and quick processing times. They often provide a range of tools to help you compare rates easily. For those considering unique financial situations, such as refinancing a house after a short period, you might explore options to refinance house after 6 months to leverage improved financial conditions. Steps to Refinance Your Home

FAQs About Refinancing Your HomeWhat credit score do I need to refinance my house?Typically, a credit score of 620 or higher is recommended for refinancing. However, some lenders may have different requirements. Can I refinance my house if it’s in foreclosure?Refinancing a house in foreclosure can be challenging, but not impossible. There are specialized lenders who might assist in such situations. For more information, you can explore options to refinance house in foreclosure. How much does refinancing cost?Refinancing costs typically range from 2% to 5% of the loan amount. These costs can include application fees, appraisal fees, and closing costs. https://www.usbank.com/home-loans/refinance.html

Reach your goals with refinancing options from U.S. Bank. Rate-and-term refinance. Lower your rate and ... https://finance.yahoo.com/personal-finance/mortgages/article/best-mortgage-refinance-lenders-161445533.html

The Yahoo view: Truist earns top honors for refinancing because of its broad selection of loans, no doubt contributing to its standing as a top ... https://finance.yahoo.com/personal-finance/mortgages/article/best-cash-out-refinance-lenders-134200722.html

Bank of America ... The Yahoo view: Bank of America does big business in conventional loans. And it offers a unique tool to help you get started ...

|

|---|